Among the most powerful tools in this arena are Facebook Ads, which enable financial professionals to reach a wide array of potential clients on the largest social media platform on the planet.

Whether you're an advisor who is new to Facebook ads, or you have some experience and are just looking for a refresher on best practices, this guide will walk you through everything you need to know to effectively utilize the platform to attract leads and grow your business.

Whenever you allocate resources toward marketing, it’s only natural to ask what you’re getting in return. So, is your money worth spending on Facebook ads? What can this budget do for your client pipeline? Isn’t everyone moving to TikTok these days, anyway? Before we get to strategy, let’s first highlight why Facebook ads are such a popular advertising tool.

Facebook remains the largest social platform in the world, with over 2 billion daily active users. One basic principle of advertising is to go where the eyeballs are – and Facebook undoubtedly has lots of eyeballs.

When done right, Facebook ads have been proven to convert. This ad platform is so widely utilized across industries – from eCommerce to financial advice – because it can successfully turn users into customers or clients.

With that said, the phrase “past performance is no guarantee of future results” applies to the world of marketing, too. Just because a particular ad variation, marketing strategy (or even an entire advertising platform) is effective today, doesn’t mean it will yield the same results tomorrow.

Financial advisors have gravitated toward Facebook ads because of the robust targeting options that have made it simple to target highly-specific audiences.

While there has been a recent shift in the privacy winds that have made user targeting far more challenging for advertisers, it’s still possible to select at a granular level who will see your ads. We’ll cover this topic more in-depth later on.

Before you launch your first ad campaign, it’s important to define your goals. Are you looking to generate leads? Get more website visitors? Grow your Facebook page? The objectives you land on will guide your strategy, so it's essential to pinpoint them from the outset. Once you decide what you want to accomplish, you can then tailor your advertising efforts specifically for those goals.

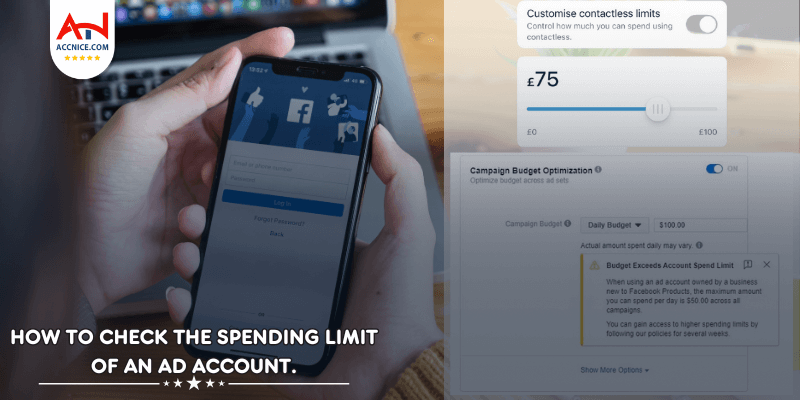

It’s important to earmark how much you’re comfortable spending on advertising upfront. Decide how much a lead is worth to you, and use that number as a benchmark for your advertising performance.

Facebook advertising costs can vary widely depending on factors like your target audience, ad quality, and bidding strategy, but research shows that Facebook ads relating to financial services tend to have a higher cost-per-click (CPC) than any other industry, at $3.77 per click.

It’s worth noting that this is still a far cheaper CPC rate than on other platforms (like Google Ads, for example).

We’ve covered the “why.” Now for the “how.”

Financial advisor Facebook marketing strategy can be broken down into four main components:

Let’s begin with arguably the most essential component of any advertising strategy, the creative. An effective Facebook ad has three main elements: a compelling visual, engaging copy, and a clear call to action. Here’s an ad that Altruist ran on Facebook for our Content Marketing Playbook:

For more financial advisor Facebook ad examples, you can browse Facebook’s Ad Library to see if any colleagues or competitors are running ads and what types of creative they’re running.

With that said, ad creative is more than just a catchy headline and an attractive visual. It's also important to choose the right ad format and placement for your message.

There are a range of ad format options – from single image and video ads, to carousel designs that feature multiple, scrollable visuals. All of these have their own specifications, so be sure to consult Facebook’s ad spec guide as you develop your creative.

If you’re just starting out with Facebook ads for your financial advising business, aim to keep your ads formats as simple as possible while you test different creative options (as well as audiences) and learn what's most effective.

Before publishing, you’ll also be asked to choose ad placements. This feature dictates where your ads appear in the Meta ads network (which also includes Instagram). A good bet is to select “automatic placements,” which lets Facebook show your ads where it thinks they will perform best.

Alternatively, if you have a clear vision for where you want your ads displayed and how you’d like them to look, you can manually select those options before publishing your ads on the platform.

Identifying who you want to reach is the next crucial step in mapping your ad strategy. Facebook allows you to segment your advertising audience by basic demographics, location, and even psychographics, such as interests and behaviors. If you have a good idea of who your target audience is, you can use these features to narrow down your audience and ensure only the ideal user profiles are seeing your ads.

In the example below, you’ll see a scenario where someone is targeting all residents of California, age 45-60, whose zip codes are in the top 5% of household income in the U.S. and who’ve shown interest in topics related to personal finance.

However, these manual segmentation selections only scratch the surface of Facebook’s targeting capabilities.

As mentioned above, evolving data privacy policies have changed the way online advertising works. It used to be that Facebook’s pixel could easily track users around the web to serve ads highly relevant to them. If a user had visited a financial services website and went back to Facebook, for example, they would likely receive ads about financial services.

That method of serving ads (known as retargeting) has become far less effective as privacy changes have made it harder to accurately track users’ behavior across the web.

While some of those powerful tracking methods are no longer viable, that doesn’t mean you can’t use Facebook’s existing advertising tools to get your message in front of the right people.

In this new era of digital advertising, first-party data is king. First-party data is anything you or your business collects directly (as opposed to relying on a third-party service or platform).

Examples of first party data include information gathered from:

Note: it is important to make sure you’re handling this data responsibly and only in ways that abide by your firm’s privacy policy.

With proper user consent, advertisers can create what’s called a “Custom Audience” by uploading this first-party data to Facebook (where it is immediately anonymized to protect user privacy). This audience will be composed solely of users Facebook can accurately match to existing profiles based on the information you’ve provided.

You might be thinking: why is that helpful? If I’ve already got these prospects in my pipeline, what’s the point in giving that information to Facebook?

The answer is to create Lookalike Audiences.

A Lookalike Audience is exactly what it sounds like – a generated audience of users similar to those in your Custom Audience. Facebook’s platform takes the information you’ve given it about the people already in your network, and builds a much larger audience of new people it thinks are similar to your target profile(s).

According to one study, 9 out of 10 ads delivered to Lookalike Audiences had a higher CTR (click-through-rate) compared to ads not using lookalikes – making this a go-to strategy that advisors use to boost their chances of reaching the right people with their Facebook ad spend.

First, we covered what your ads should look like, then we highlighted who will be seeing them. The third key component of a financial advisor’s Facebook marketing strategy is the action you want people to take once they click on your ad.

This ties back to your advertising objectives, as the conversion action you choose will depend on what your goals are. However, there are a couple of general rules you should follow.

First and most importantly, don’t send users to a landing page that isn’t optimized for conversion (e.g. your home page). If someone has clicked on your ad, that means they’re interested in your message – don’t lose them right away with a disjointed content experience. Instead, create a custom landing page that is tailored specifically to the action you want them to take.

Secondly, recognize that it’s rare for a user from a cold audience to turn into a warm lead immediately. In other words, it’s unlikely someone who has never heard of you will click a Facebook ad and book a call straight away.

Try to nurture your leads slowly while you establish yourself as a source of authority in the financial space. Instead of a hard sell upfront, think about building trust and transitioning people into your prospect pipeline.

What does that look like? Here are a few ideas for nurturing leads via Facebook ads:

Finally, make sure you have conversion tracking set up correctly. Without this crucial part of the puzzle, it will be difficult to tell which ads are working and which aren’t.

Understanding the data behind your ads is key to finding success. The Facebook Ads Manager Dashboard offers a wealth of analytics and performance metrics to help you gauge your ads' effectiveness.

While there are hundreds of different metrics available to track, you’re best off focusing on key performance indicators (KPIs) such as impressions, cost-per-click, cost-per-result (CPR), and overall conversion totals. Taken together, data points like these can help you determine whether your ads are delivering the results you want (and at a price that makes sense for your budget).

Facebook ads reporting dashboard example

Successful Facebook ad campaigns are rarely one-hit wonders. To get the most out of your performance, you’ll want to test different variations of ad creative, ad format, and audiences.

If something isn’t working, don’t sit back and hope for improvement – try another combination. Utilize A/B testing to pit your combinations against one another and see what performs best.

When you find something that works, you can increase the budget for that ad campaign and scale it up to reach more people and generate more leads.

The last important point to cover relates to compliance – both for Facebook’s advertising policies and for your firm.

When advertising on Facebook, you must abide by the platform’s rules for financial services ads. Facebook's policies restrict certain types of financial content, and in general, financial services ads receive a higher level of scrutiny before getting approval.

In addition to Facebook's rules, financial advisors must adhere to specific compliance regulations. The Financial Industry Regulatory Authority (FINRA), the Securities and Exchange Commission (SEC) as well as state regulators all have rules and guidelines for advertising and social media use. It's crucial to be familiar with these regulations to avoid potential issues, and your compliance team should review your firm’s social media policies to make sure they comply with applicable regulatory guidelines. Make sure your firm is also compliant with applicable recordkeeping requirements. You may want to consider using a vendor to help with this.

Every business is different, and every marketing budget is different, but if you haven’t incorporated Facebook ads into your marketing strategy, realize that you may be leaving a valuable resource untapped.

Facebook advertising provides a large and dynamic platform for financial advisors to reach new clients and grow their businesses. By mastering the best practices, measuring your results, and continually refining your strategy, it’s possible to leverage Facebook ads as a powerful lead-generating tool for your business.